You can plan ahead to see when big expenses are due and set reminders to avoid late fees. When you track your monthly expenses and bills, you’ll get a better understanding of how your money flows in and out each month.

Sounds good, right? Improve your cash flow You’ll also notice that when you start paying off debt, you’ll have fewer bills due each month. This can help you avoid those annoying late fees and improve your credit score if you’re not missing payment due dates. With a well-planned calendar, you’ll minimize the chance of forgetting the due dates of important bills and special events, such as birthdays. Here are a few of the key benefits of using a budget calendar: Fewer missed bills Benefits of a budget calendarĪ budget calendar can help remind you of all the important dates in a given month. A budget calendar is an easy way to see what you’ll spend money and when.īeing able to look ahead at the month’s expenses and special events allows you to plan and get into the habit of making better spending habits so you can save money.įor example, if you have a big bill due this month, you might cut back on your daily spending a week prior to make sure that you have the money set aside to cover the bill payment. Read Next: How to budget when you live paycheck to paycheckīeing able to visually see your paydays, when bills are due, upcoming purchases, and savings contributions, can help you to better manage your money and reduce surprises. It means if something unexpected happens, like an emergency car repair, you could overdraw your bank account.

Living paycheck to paycheck means you have $1,000 (or less) in savings. If you’re living paycheck to paycheck though, using a budget calendar is essential. It’s free to use, easy to follow, and it can help reduce financial stress. This will help you remember to include these extra expenses in your budget, such as buying a gift for a baby shower or setting aside money for a family dinner party.Īnyone can benefit from using a budget calendar. You’ll want to include any special events, holidays, or birthdays on your budget calendar. Special events or holidaysĮach month will look different depending on the time of year.

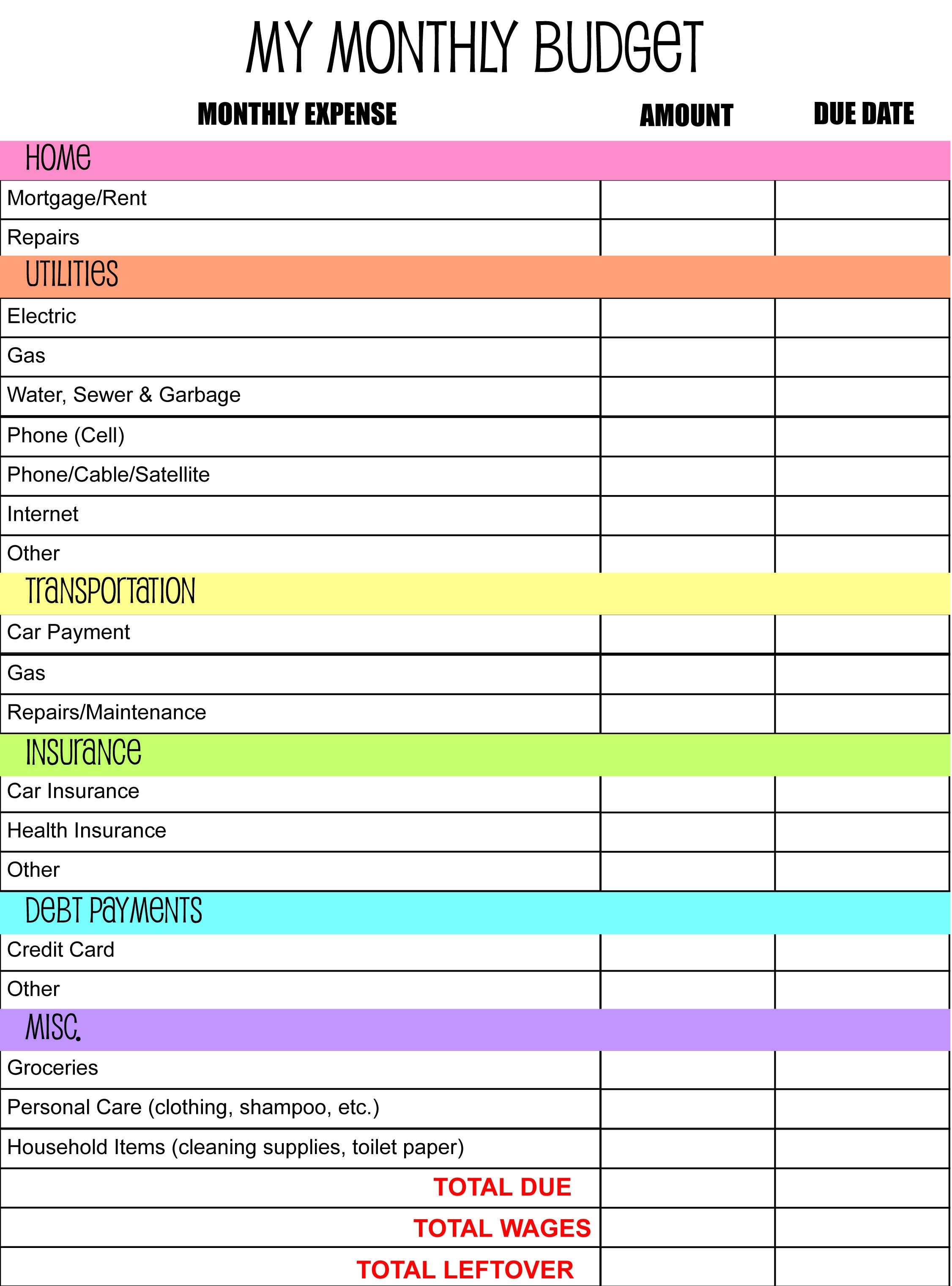

This can be a great way to save up for a wedding, a vacation, or build your emergency fund. If you manually transfer money to your savings account, then list the days you plan to do this on your budget calendar too. If you have automatic savings contributions set up, schedule them in your budget calendar so you’ll know when money is automatically withdrawn from your account. When you have your bills and their due dates listed, you can decide which paycheck will cover each and every bill. Make a note of all your regular monthly bills on your budget calendar, such as your rent / mortgage and cell phone bill.Īlso make note of irregular expenses that are due during this month, such as yearly subscription charges. This will allow you to visually see which days you’ll get paid and when money will be flowing in. Include your paychecks on your budget calendar, including other income sources. Here’s a few things that you may want to include in your budget calendar: Income It can be used as a calendar for paying bills and other financial obligations. The purpose of a budget calendar is to keep track of all payment amounts and when their due dates. What is the purpose of a budget calendar? How do you create a monthly budget for a beginner?.How to use your budget calendar throughout the month.What if I can’t pay all my bills with just one paycheck?.List your monthly bills and their due dates How do I create a personal finance calendar?.What is the purpose of a budget calendar?.(Or peanut butter and jelly if that’s your jam!) It’s a visual aid to see your paydays, when bills need to get paid, and what’s coming in the months ahead so you can plan accordingly.Ī budget calendar goes together with your monthly budget like peas and carrots. If you’re looking to get a better handle on your finances and manage your spending, a budget calendar is designed to help you do just that. With a budget calendar, you can set reminders to pay bills on time or to purchase a gift for an upcoming birthday celebration. But did you know that a calendar can also be a great tool for budgeting? Many of us use a calendar to help us keep track of important dates in our life, such as doctor’s appointments, meetings and vacations. It’s a helpful way to get an overview of how much money will flow IN and OUT in a given month. What is a budget calendar? A budget calendar looks just like a regular calendar, but it’s used for the purpose of tracking your bills, due dates, paychecks, and other important dates in your life.

0 kommentar(er)

0 kommentar(er)